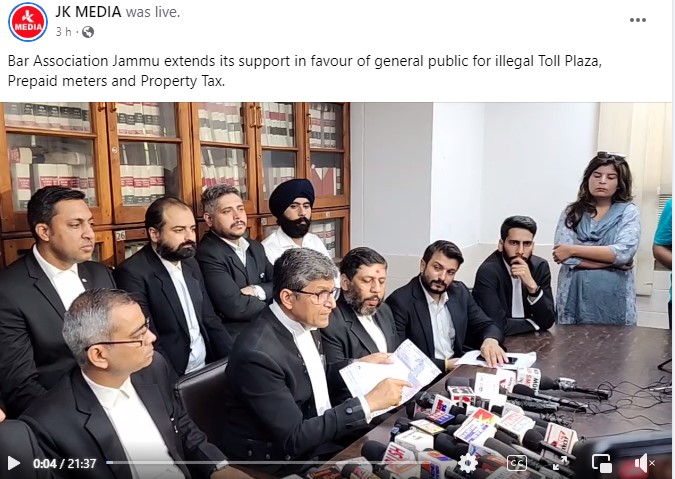

Bar Association Jammu holds conference, extends support to burning issues of Jammu

Aman Zutshi

Jammu: Bar Association Jammu on Monday held a press conference in Jammu and extended their support to the burning issues and talked extensively about the Sarore toll plaza, smart meters and property tax which the masses are facing the burnt of.

Addressing a press conference, Bar Association Jammu, President Mr Vikram Sharma, said, “Recently, an electric consumer received bill of Rs 1,96000 if the PDD department has not increased electricity bill per unit for newly installed smart meters then why there is Rs 34000 opening balance of smart meters and outstanding amount appeared Rs 1,96000 of the same, then that means the smart meter is at fault.

Also Read: Section 144 imposed in Jammu

“If there is a fault in smart meters then why shouldn’t consumers raise their voice and it is the obligation of the authorities to take cognisance of these outstanding tariffs and probe them as they’re being generated by them for the local electricity consumers. Which means something is wrong somewhere.

“If smart meters are showing such faults and producing these outstanding bills then there is a possibility that after few months the regime can introduce new type of electric meters.

“If we recollect your memory this is the fourth level of electricity meter which are installed in our households, but earlier there were small electricity meters which showed no problem and even the PDD faced no greivances that time.

“Whenever a corporation comes they have to balance between the expenses incurred and revenue generation. When the traditional meters went out of fashion then electric meters were introduced by the govt in Jammu claiming that the traditional meters were unable to detect electricity theft and there was revenue loss.

“The authorities said that they will protect tariff loss by installing the electric meters then why those electric meters suffered faults. The PDD should take the onus.

“Earlier, the Jammuities supported PDD and paid money for the installation of electric meters, after govt claim to stop the burglary of electricity that time when the electric meters were introduced then why those meters witnessed faults.

“The govt put additional burden on consumers. The govt should accept their fault that those meters were faulty and also those who certified them as eligible meters.

“The masses will follow the steps of regime and the govt ensured them these meters are good.

“If smart meters are generating electricity tariffs in lakhs for just 200 units and the consumers grievance are not being addressed on this issue then why should govt think the people will not make an uproar and the bar association is against this and we support people.

“If the PPD is getting 100 units out of which some units appeared faulty then that means it is not a smart meter and if it is not then the PDD should reconsider smart meters and would have postpone their installation for a while.

“However, the PDD didn’t paid heed to faulty smart meters and forcefully installed them on a peace loving tax payer society.

“If Jammu region is the highest tax payer then rest of other states then why the govt didn’t paid any attention to people’s issues regarding the smart meters.

“The despensation should redress local people issues on smart meters who’re getting high electricity tariffs.

“The uproar of Jammu people on the roads is a secondary issue and it can be the extreme form of representation.

“But being citizens of India who are being governed by its constitution which is also applicable on the govt we want a speedy action by the govt on the public matters and we are in support with the people of Jammu. It is a unanimous decision of High Court Bar Association and Young Lawyers association to support the Jammu people as we have done earlier.

Talking about the recently implemented property tax in the J&K UT, Mr Vikram Sharma further asked why the J&K people forgot about the land tax whose first installment is due on August 31.

He further added that before the implementation of property tax in Jammu a delegation comprising of DC Jammu, Municipal commissioner met with them for their inputs and they also later met LG Sinha regarding the same, who assured them that positive results will come out from the imposition of land tax in J&K.

He further added that the Bar Association Jammu suggested the then visiting delegation of the govt that the scope of land tax exemption should be increased from 700 sq ft to 1500 sq ft keeping in view the financially weak middle class community of Jammu and along with orphanages, Nari Niketans on which LG sir paid attention.

“We want LG Sir to work on these requests to provide relief to the wider section of Jammu from land tax as Jammu don’t belong to the elitist rich section of the society”, he appealed.

He also suggested the simplification of the calculation of house tax so that masses can calculate the property tax.

Answering the query regarding the Sarore toll plaza, Bar Association Jammu, President Mr Vikram Sharma, added, “We will be happy if a client comes to us regarding Sarore toll plaza issue and there is no problem giving legal notice to NHAI.

He further said that they were waiting the decision of NHAI on Sarore toll plaza issue and they will wait would the NHAI will follow its norms or not regarding the same.

Replying to a media query on the demand of Jammu Bandh call by Yuva Rajput Sabha, Jammu Transport association in the coming days, the Bar association president said that the bar don’t think there are lot of efforts needed to gather Jammuities on significant matters. He said that it is their responsibility along with social groups and elected representatives to explain people about the cons and pros of a particular issue so that they can agitate.

He further stated that the Bar association always agitated peacefully rather aggressively. The local regime should at least issue a notice regarding the exemption of toll place till the the road completion. “The govt should also reply about the honorable MP who said recently in parliament that two toll plazas can’t be installed within a distance of sixty kilometers and why the National Highways Authority of India (NHAI) hasn’t taken any action yet”, he asked.

“There is not a single issue of Jammu which is not raised by Bar association and which we didn’t concluded successfully”, he asserted.

Moreover, he said that the aim of today’s press conference organised by Bar association Jammu is to address concerns of Jammu and they expect authorities including transport ministry and NHAI to respond to their appeal positively and they will wait the answer of the mentioned authorities regarding the issue.

Answering another press query regarding the withdrawal of Chamber of Commerce & Industry Jammu and Bar Association Jammu after the implementation of property tax in J&K he said that their attention was toll plazas today, but they have not withdrawn their support regarding the land tax because they also raised this issue with authorities on which considerations are still being taken by the govt.

He further said that there is a pending litigation in supreme court which challenges the constitutional bias of land tax implementation in J&K and even after its imposition there is not a restricting order by the local govt, which simplifies the property tax for the poor people of Jammu, which solely was raised by the Bar Association Jammu and they will never step down.