Over 17,000 Street Vendors Registered Under PM SVANidhi in J&K

48 Crore Sanctioned Under PM SVANidhi Scheme

New Delhi, Dec 18: Ishfaq Gowhar

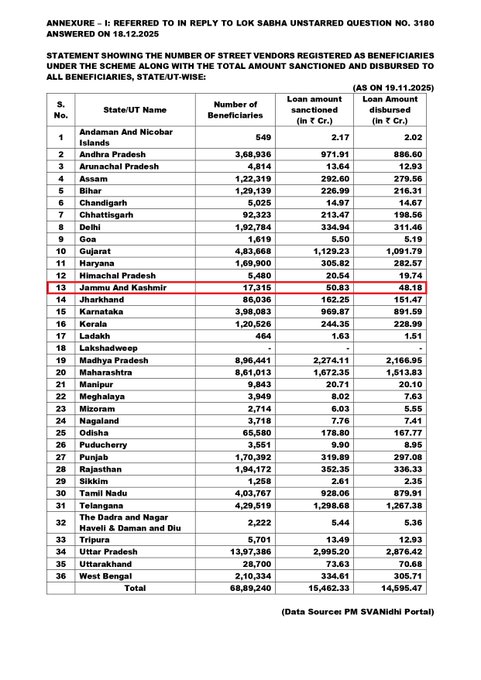

The Centre’s flagship PM SVANidhi scheme has emerged as a major lifeline for street vendors in Jammu and Kashmir, with more than 17,300 vendors brought under its ambit and nearly ₹48.2 crore already disbursed as collateral-free loans, according to official data tabled in the Lok Sabha.

As per details shared by the Union Government in response to an unstarred question, a total of 17,316 street vendors in Jammu and Kashmir have been registered as beneficiaries under the scheme. Loans worth ₹50.83 crore have been sanctioned so far, of which ₹48.18 crore has already reached beneficiaries, reflecting a high disbursement rate.

The data highlights the growing footprint of PM SVANidhi in the Union Territory, where thousands of small vendors—selling fruits, vegetables, food items, and daily essentials—have gained access to formal credit for the first time. Officials say the scheme has helped vendors revive their businesses, improve cash flow, and reduce dependence on informal moneylenders.

At the national level, the scale of the scheme is even more striking. Across India, over 68.89 lakh street vendors have been covered under PM SVANidhi. The total loan amount sanctioned nationwide stands at ₹15,462.33 crore, while ₹14,595.47 crore has already been disbursed, underscoring the government’s push to strengthen the grassroots economy.

Among major states, Uttar Pradesh leads the chart with more than 5.39 lakh beneficiaries and loans exceeding ₹1,298 crore sanctioned. States such as Madhya Pradesh, Maharashtra, Tamil Nadu, Karnataka, and West Bengal have also recorded substantial participation, reflecting widespread adoption of the scheme across urban and semi-urban centres.

Launched in the aftermath of the COVID-19 pandemic, PM SVANidhi aims to provide collateral-free working capital loans to street vendors, enabling them to restart businesses disrupted by lockdowns. Beneficiaries who repay loans on time are also eligible for higher loan tranches and interest subsidies, encouraging financial discipline and credit history creation.

The government said the figures are based on data from the PM SVANidhi Portal and demonstrate the scheme’s role in promoting financial inclusion, self-employment, and economic resilience among some of the most vulnerable sections of society.